tax avoidance vs tax evasion examples

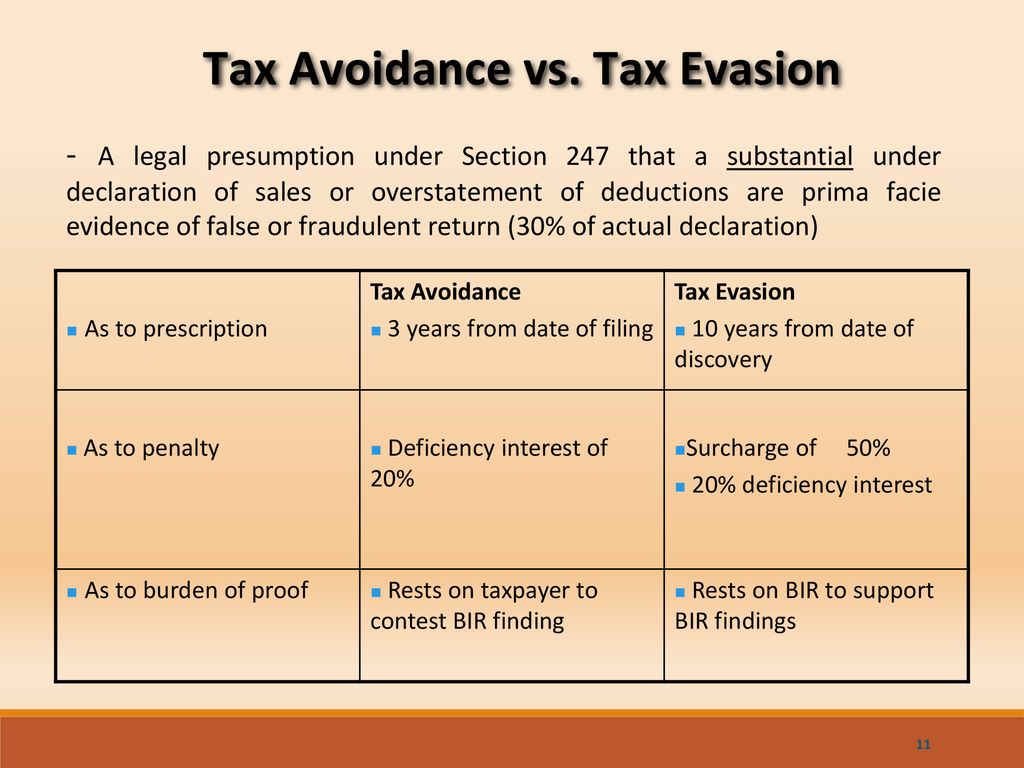

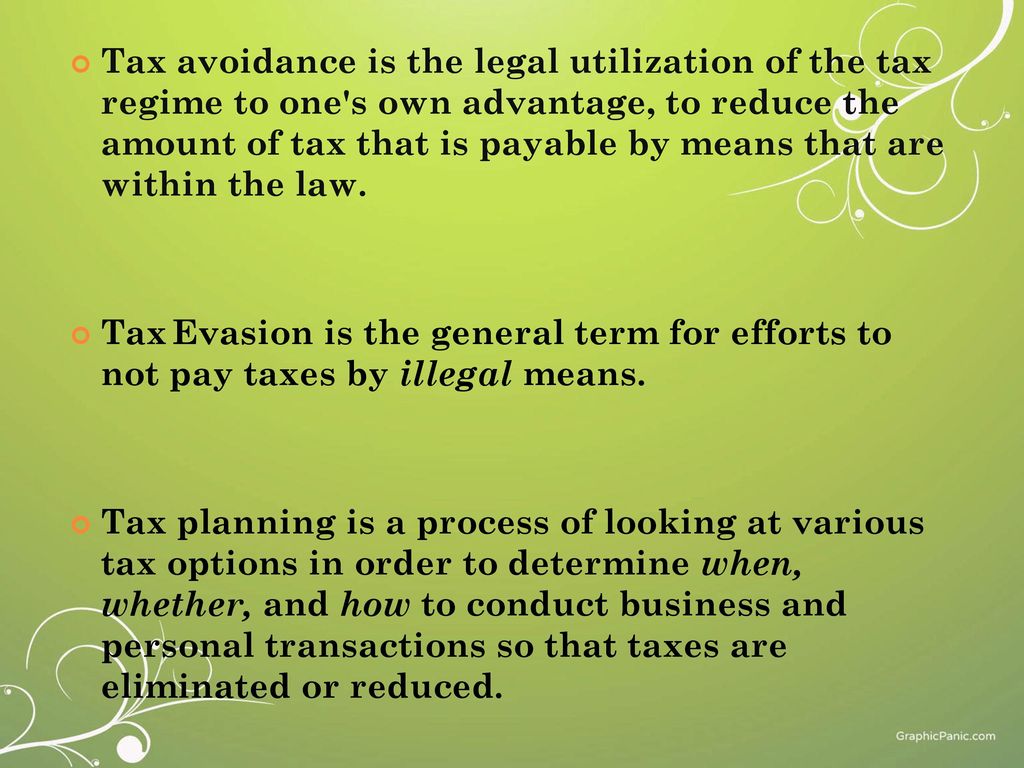

Tax evasion is the use of illegal means to avoid paying your taxes. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business.

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu

Are you unsure of the difference between tax avoidance vs.

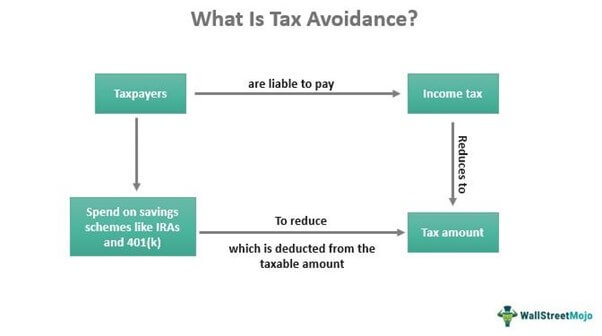

. Moreover one of the common examples of tax avoidance to minimize a taxable income is. Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed. Here are some examples of tax avoidance strategies.

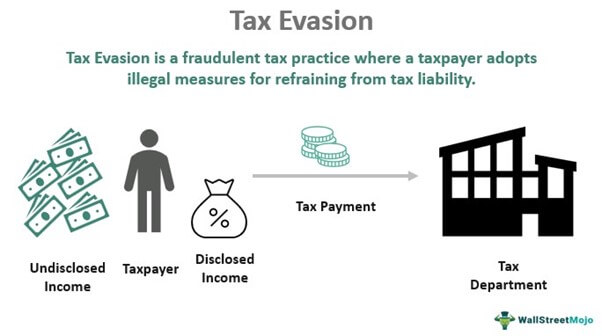

On 16 Feb 2022. Tax evasion occurs when the taxpayer either evades assessment or evades payment. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

Avoiding tax is legal but it is easy for the former to become the latter. Tax-advantaged retirement accounts including IRAs and 401ks allow you to reduce your. Tax evasion is a felony.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax evasion is often confused with tax avoidance. Tax avoidance is another way of reducing your tax burden but in a very different way from tax evasion.

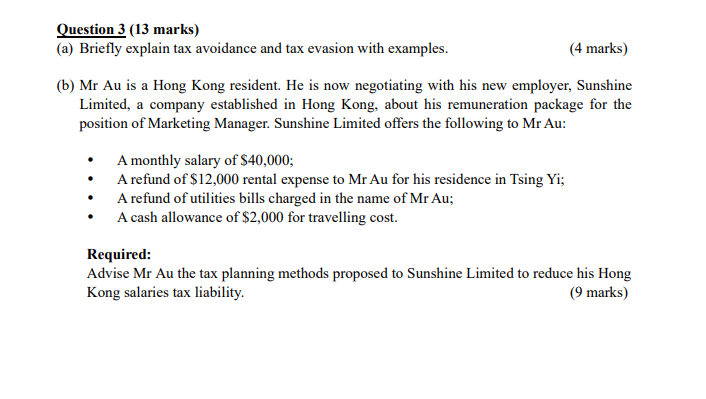

It is a legal strategy that. Hence check the details below to get to know about tax evasion vs tax avoidance. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes.

Tax avoidance unlike tax evasion is a. The difference between tax avoidance and tax evasion essentially comes down to legality. Tax evasion includes underreporting income not.

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. Tax evasionThe failure to pay or a. To start with tax avoidance is legal while tax evasion is illegal.

Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the. Tax Evasion vs. Tax avoidance is the use of tax-saving.

Here are some examples of tax avoidance strategies. Tax evasion can lead to a federal charge fines or jail time. This is much easier to define as to have.

Tax Avoidance Examples Five examples of tax evasion tax fraud and 4 examples of common tax avoidance strategies. It is a legal strategy that. What is tax avoidance vs tax evasion.

What is tax avoidance vs tax evasion. Is tax avoidance legal or illegal. Tax avoidance unlike tax evasion is a.

This is generally accomplished by claiming. Maximizing your retirement contributions.

Tax Evasion Vs Tax Avoidance Difference Examples Supermoney

Tax Avoidance Meaning Methods Examples Pros Cons

Solved Question 3 13 Marks A Briefly Explain Tax Chegg Com

What Is Considered Tax Evasion

Tax Avoidance Definition Business Examples Tax Saving Loopholes

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Tax Avoidance Vs Evasion A Lesson In Semantics Raven Rucker

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Tax Avoidance Vs Tax Evasion What Are The Penalties

How To Reduce Your Tax Legally And Ethically Ppt Download

Tax Evasion Tax Avoidance Definition Comparison For Kids

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Tax Evasion Ppt Download

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance According To Texas Law Philip D Ray